More than four years ago, the Internal Revenue Service (“IRS”) expressed serious concern about monetized installment sales that, through the use of an intermediary and an installment note, purport to defer recognition of gain and income tax due on the sale of appreciated assets despite the seller’s effective, immediate receipt of substantially all of the cash proceeds. See Chief Counsel Advice Memorandum (CCA_2019103109421213) (dated October 31, 2019, and released on May 7, 2021 (No. 202118016)). The IRS noted that the transactions lack any genuine indebtedness, involve economic benefits and/or deemed payments that are not reported by the sellers, and insert intermediaries that are not true acquirers under Section 453 of the Internal Revenue Code (providing for installment method of reporting income for installment sales). The IRS also made it clear that a 2012 IRS Memorandum (NSAR 20123401F (Aug. 24, 2012)) does not support a monetized installment sale unless the pledge involves the sale of agricultural property.

The IRS sounded the alarm on abusive monetized installment sales in its annual Dirty Dozen lists in 2021, 2022, and 2023. In addition to these public announcements, the IRS has been pursuing promoters involved in these transactions. For example, in January 2023, the U.S. District Court for the District of Utah denied eight petitions to quash, and ordered the enforcement of, IRS administrative summonses issued to financial institutions in a promoter investigation involving monetized installment sale transactions. Bishop, et al v. United States, et al, Case Nos. 2:22-cv-00340, 00341, 00344, 00345, 00347, 00348, 00351, and 00352 (D. Utah) (appeal pending in the Tenth Circuit, Case No. 23-4023).

Last week, the IRS published a Notice of Proposed Rulemaking issuing proposed regulations identifying Monetized Installment Sales and “substantially similar” transactions as listed transactions. Comments to the proposed regulations must be received by October 3, 2023.

A listed transaction is a type of reportable transaction that the IRS has determined to be a tax avoidance strategy and requires participants to file disclosure statements with the IRS identifying their involvement. Moreover, individuals who are considered “material advisors” to such transactions have their own IRS reporting and record-keeping requirements. A material advisor is any person who provides “any material aid, assistance, or advice with respect to organizing, managing, promoting, selling, implementing, insuring or carrying out” such listed transactions and directly or indirectly derives at least $10,000 in gross income from such activities when substantially all of the tax benefits from the transaction are provided to natural persons (looking through pass through entities and trusts), and at least $25,000 in gross income for all other listed transactions. See 26 C.F.R. § 301.6111-3(b)(3). The obligation to file disclosure statements is not only forward looking but can also include prior tax years if the statute of limitations for assessment of tax for a particular period is still open.

Penalties for failing to comply with listed transaction reporting requirements are harsh. For taxpayers, the penalty is 75% of the amount of tax that would have been owed if not for the participation in the transaction (the minimum penalty is $5,000 and the maximum penalty is $200,000); for material advisors, the penalty can be up to 75% of the advisor’s gross income derived from assisting with such transactions (the maximum penalty is $200,000). Penalties for failure to maintain and provide records to the IRS on demand can also be as much as $10,000 per day for each day that the failure to provide records continues. These reporting and record-keeping penalties can be assessed even if the transaction is ultimately sustained by the IRS or courts. Complying with the reporting and record-keeping requirements can require legal advice on several issues, including whether a transaction is “substantially similar” to the listed transaction necessitating disclosure, whether someone is a “material advisor,” and technical aspects of reporting compliance.

Background on Monetized Installment Sales

The proposed regulations identify Monetized Installment Sales as follows:

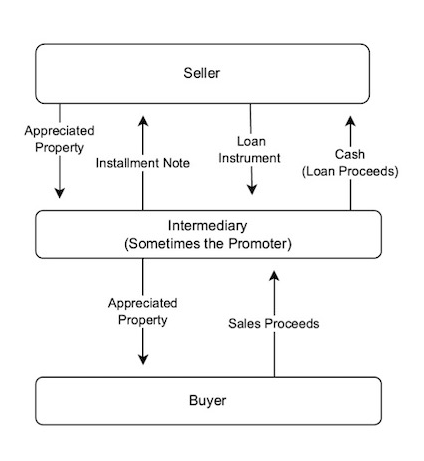

In a typical transaction, the intermediary issues a note or other evidence of indebtedness to the seller requiring annual interest payments and a balloon payment of principal at the maturity of the note, and then immediately or shortly thereafter, the intermediary transfers the seller’s property to the buyer in a purported sale of the property for cash, completing the prearranged sale of the property by seller to buyer. In connection with the transaction, the promoter refers the seller to a third party that enters into a purported loan agreement with the seller.

The intermediary generally transfers the amount it has received from the buyer, less certain fees, to an account held by or for the benefit of this third party (the account). The third party provides a purported non-recourse loan to the seller in an amount equal to the amount the seller would have received from the buyer for the sale of the property, less certain fees. The “loan” is either funded or collateralized by the amount deposited into the account. The seller’s obligation to make payments on the purported loan is typically limited to the amount to be received by the seller from the intermediary pursuant to the purported installment obligation. Upon maturity of the purported installment obligation, the purported loan, and the funding note, the offsetting instruments each terminate, giving rise to a deemed payment on the purported installment obligation and triggering taxable gain to the seller purportedly deferred until that time.

In simple terms, a Monetized Installment Sale proceeds as follows:

As noted, the proposed regulations also apply to any transaction that is deemed to be “substantially similar” to the above-described conduct. A transaction is “substantially similar” to a listed transaction if it is “expected to obtain the same or similar types of tax consequences and that is either factually similar or based on the same or similar tax strategy.”

As noted, the proposed regulations also apply to any transaction that is deemed to be “substantially similar” to the above-described conduct. A transaction is “substantially similar” to a listed transaction if it is “expected to obtain the same or similar types of tax consequences and that is either factually similar or based on the same or similar tax strategy.”

If you engaged or assisted in a tax-deferral strategy whereby appreciated property was sold in return for an installment note (or similar instrument) with a balloon payment after the year of the sale, but with the seller receiving cash loan proceeds in the year of the sale, you may have IRS reporting and record keeping requirements when the proposed regulations are finalized.

When the IRS identifies a listed transaction, it often also pursues a concurrent strategy of opening civil promoter penalty investigations and conducting taxpayer audits. The IRS can also initiate criminal investigations to determine whether participants’ involvement in the listed transactions involves fraud or other criminal conduct. To the extent you have been contacted by an IRS agent or investigator; received correspondence from the IRS, including requests for information or documents; or are aware of associates, clients, or advisors receiving summons or subpoenas, a prudent course of action is to retain experienced legal counsel to help you navigate the legal process.

(Updated August 8, 2023)

Over the past 75 years, Kostelanetz LLP has built a global reputation as a law firm of choice for clients facing high-stakes controversies and negotiations with government agencies. Our attorneys have extensive experience in tax controversies and white-collar criminal defense and are regularly called upon to handle the most challenging and sensitive cases and internal investigations. Important parts of the firm’s practice include tax and estate planning, commercial litigation, government procurement, and government contracting.

Many of our attorneys have served as former senior officials within the Internal Revenue Service, the U.S. Department of Justice, and other federal and state prosecutors’ offices. Several of the firm’s attorneys have served as federal judicial law clerks and/or have master’s degrees in taxation.

The firm and its attorneys have been honored and recognized by major, independent national and international legal rankings agencies, including Chambers USA, The Legal 500, Best Lawyers, and Super Lawyers. Several of our partners teach at top law schools, present CLE/CPE courses on tax-related and legal ethics topics, and are often hired as expert witnesses or consultants in tax controversy litigation.